New Inflation Reduction Bill

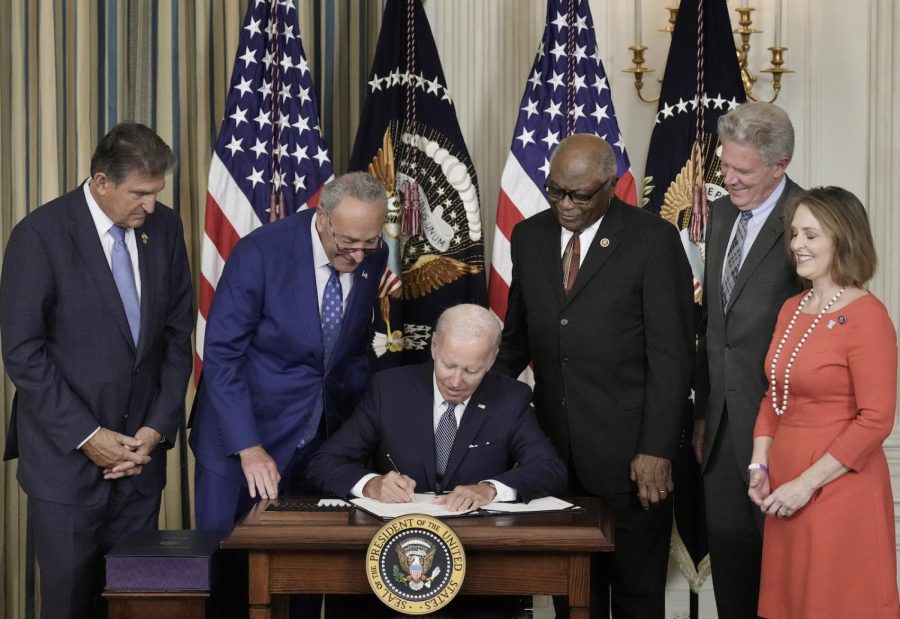

President Biden reintroduced the new Inflation Reduction Act (IRA) in his State of the Union Address. Signed into law on Aug. 16, it marks the third major legislation targeted at increasing economic competition and domestic productivity.

The law’s provisions set up pathways to expand sustainable energy industries, support and enforce employee wages, revitalize American manufacturing, and provide affordable health care.

In the domain of clean energy, the IRA has helped to increase jobs in rural and smaller community areas, especially in Arizona, Nebraska, Tennessee, and Georgia. According to www.cnbc.com, at least 10,000 new jobs have been created in each of the four states, with a total of about 100,000 new clean energy industry jobs in the nation since the law’s signing.

With intensified focus on sustainable energy and cultivating a green economy, the effect of the IRA is expected to decrease carbon emissions by 40% within the next seven years. The goals listed on www.whitehouse.gov detail that the administration intends to build 950 million solar panels and 120,000 wind turbines in order to take strides in eliminating one billion metric tons of emissions, the most ambitious climate impact to date.

By offering tax incentives and subsidies, the government encourages the economy to shift towards cleaner energy and the development of stronger domestic industry. This transition (if successful) it would result in more available solar and wind energy, as well as consumer technology.

The health care provisions in the IRA also plan for making essential prescription drugs and services more affordable for Medicare holders. Under the new legislation, Medicare has the potential to lower drug costs through negotiations with pharmaceuticals. The IRA additionally emphasizes the wide cost and price gap in the insulin industry, establishing a price ceiling of $35 for one month’s supply. Regarding the Affordable Care Act, although its sunset provision establishes a termination of the policy, thereby putting millions of beneficiaries in jeopardy, the IRA extends the program for another three years.

In his address, Biden points out a problematic issue regarding the tax system, in that 55 of the largest corporations in America paid no federal taxes in 2020. Under the IRA, however, there would be a minimum of 15% tax on corporations’ profits. He explains that families with incomes less than $400,000 will have no additional taxes.

Overall, the IRA stands as a distinct and influential piece of legislation that could usher in a stronger economy for Americans. With the provisions in full effect, the law invests upwards of $300 billion into decreasing the federal deficit spending to combat inflation, according to www.democrats.senate.gov. In 2023 alone, www.whitehouse.gov further details that the deficit is expected to eliminate $1.5 trillion in deficit spending.

While many of the policies in the IRA were met with an indifferent or unpleasant Republican reception, as characterized by their lack of applause in comparison to their Democrat peers, Biden declared that any effort to repeal the legislation would be met with an emphatic veto.

Aidan is a senior at Aliso Niguel High School. While it is his first year joining the Growling Wolverine Newspaper, Aidan is excited to bring his writing...